引言

美国户外产业协会(OIA)发布的《2024年美国户外活动参与度趋势报告》为我们揭示了近年来美国户外活动的发展趋势和关键数据。这份报告不仅是户外品牌和非营利组织的宝贵资源,也是理解户外市场变化、制定战略决策的重要依据。本文将对报告的核心内容进行翻译和深入分析,探讨户外活动的增长动力、面临的挑战以及未来的发展方向。

一、报告概述

本报告由户外基金会(Outdoor Foundation)资助,与户外产业协会(OIA)合作发布,涵盖了从2007年到2023年的户外活动参与度数据。报告指出,2023年户外活动参与者数量达到历史新高,增长至1.758亿人,占美国6岁及以上人口的57.3%。这一显著增长反映了户外活动的普及程度和多样化趋势。

二、户外活动参与度的增长动力

新参与者的涌入

报告显示,2023年有770万美国人首次尝试了一种或多种户外活动。这一数据表明,越来越多的人开始接触并参与到户外活动中来。新参与者的加入不仅扩大了户外活动的参与基础,还带来了更多样化的参与人群,包括女性、少数民族和年轻人。

这种增长的一个重要方面是户外休闲参与者基数的日益多样化。2023年,超过一半的美国女性参与了户外休闲活动,参与率达到51.9%,高于2022年的50%。同样,男性的参与率也达到了创纪录的62.9%。老年人(65岁及以上)也推动了增长,其参与率从2022年到2023年增长了11.5%。此外,LGBTQ+群体仍然是户外活动的积极参与者,占户外参与者总数的11.3%。

种族和民族多样性也在上升。2023年,黑人参与者的比例从9.4%增加到10.3%,而西班牙裔参与者的比例从12.6%增加到13.4%。相比之下,白人非西班牙裔参与者的比例略有下降,从71.2%降至69.7%。

多样化的活动类型

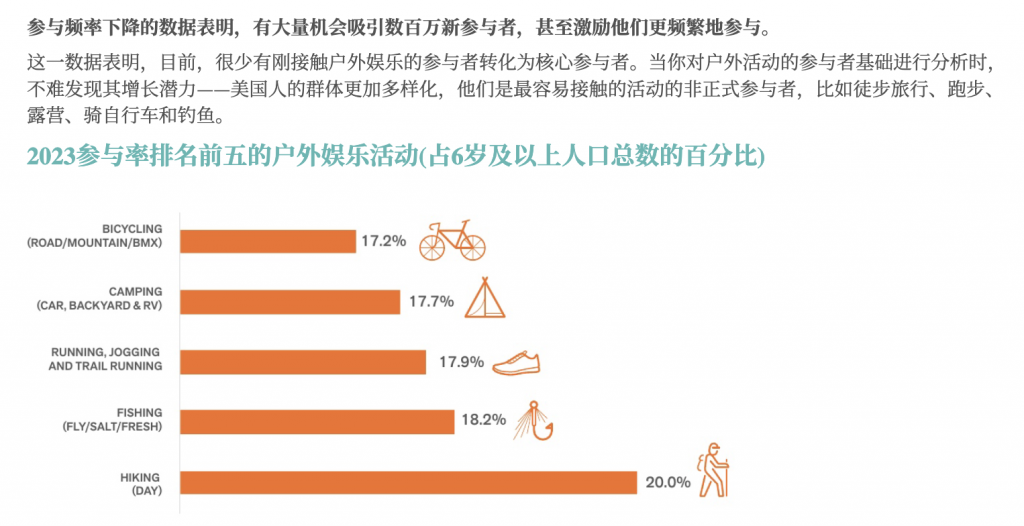

最受欢迎的户外活动包括徒步、骑行、露营、跑步和钓鱼。这些活动因其易于参与和广泛的受众基础,吸引了大量新参与者的加入。

不同年龄、性别和背景的人群都找到了适合自己的户外活动方式,进一步推动了户外活动的普及和增长。

政策与市场推动

政府和私营部门对户外活动的支持力度不断增加,通过建设基础设施、举办活动、推广宣传等方式,为户外活动提供了更多机会和便利。

同时,户外品牌也加大了产品研发和市场推广力度,满足了消费者对高品质、多样化户外装备的需求。

三、户外活动的挑战与机遇

参与度频率的下降

尽管参与者数量显著增加,但户外活动的参与频率却呈现下降趋势。过去十年间,平均每年参与户外活动的次数从84次下降到了73次。

这表明,虽然更多人开始尝试户外活动,但持续性和深度参与仍面临挑战。如何激发参与者的兴趣并保持其长期参与,是户外行业需要思考的问题。

核心参与者的流失

核心参与者(每年参与户外活动51次以上)的比例也在逐年下降。从2019年的9940万下降到2023年的8840万,平均参与率也降至28.8%。

这一趋势警示我们,户外行业正在失去一部分最忠诚和最具消费潜力的参与者。如何通过创新产品和服务,重新吸引并留住这些核心参与者,是行业发展的关键。

多样化参与者的机会

报告指出,多样化参与者的比例正在上升,包括女性、少数民族和老年人等群体。这些新参与者的加入为户外行业带来了新的机遇和挑战。

针对不同群体的需求和偏好,开发更具针对性的产品和服务,将有助于扩大户外市场的规模和影响力。

四、未来发展方向

加强市场细分

针对不同的参与者群体,进行更精准的市场细分和定位。了解不同群体的需求和偏好,为他们提供个性化的产品和服务。

例如,针对年轻人群体,可以推出更具创新性和社交属性的户外活动;针对老年人群体,则可以开发更安全和便捷的参与方式。

提升参与频率

通过创新活动形式、优化参与体验、加强社区建设等方式,激发参与者的兴趣和动力,提高其参与频率和深度。

例如,可以举办更多主题鲜明、互动性强的户外活动;利用社交媒体等渠道,分享参与者的精彩瞬间和体验感受;加强与其他领域的合作,如旅游、教育等,拓展户外活动的应用场景。

推动多样化与包容性

致力于打造一个多元化、包容性的户外环境,吸引更多不同背景的人群参与到户外活动中来。

通过开展多样性和包容性培训、推出相关政策和计划等方式,消除参与障碍和偏见,促进不同群体之间的交流和融合。

五、结论

《2024年美国户外活动参与度趋势报告》为我们提供了宝贵的洞察和数据支持。面对不断增长的市场需求和日益多样化的参与者群体,户外行业需要不断创新和发展,以满足消费者的需求和期望。通过加强市场细分、提升参与频率、推动多样化与包容性等措施,我们有望在未来看到更加繁荣和可持续的户外市场。

An Analysis of the Outdoor Industry Association’s (OIA) 2024 Outdoor Participation Trends Report

The Outdoor Industry Association’s (OIA) latest annual report, the 2024 Outdoor Participation Trends Report, provides a comprehensive overview of the state of outdoor recreation in the United States. This report, titled “Executive Summary,” delves into key insights, demographic shifts, and participation trends, offering valuable information for businesses, nonprofits, and policymakers alike. In this analysis, we will explore the main findings of the report and their implications for the outdoor recreation industry.

Executive Summary and the Importance of Data

The report opens with an executive summary, emphasizing the significance of understanding the size, demographics, and participation trends of outdoor recreationists. For over 15 years, the OIA’s Outdoor Participation Trends Report has been the go-to source for insights into who is participating in outdoor activities, when, and how. This year’s report goes beyond just data, providing actionable insights to help stakeholders stay ahead of trends, allocate resources effectively, and inform overall strategies.

The Growth of Outdoor Recreation

One of the most notable findings of the report is the continued growth of the outdoor recreation participant base. In 2023, the number of participants grew by 4.1% to a record of 175.8 million Americans aged six and older, representing 57.3% of the total population in this age group. This growth was fueled by an influx of new participants who tried one or more outdoor activities for the first time, totaling 7.7 million individuals. The report highlights that this growth trend, which began in 2016 and accelerated during the COVID-19 pandemic, shows few signs of slowing down.

New and Diverse Participants

A significant aspect of this growth is the increasing diversity of the outdoor recreation participant base. In 2023, more than half of American women participated in outdoor recreation, reaching a participation rate of 51.9%, up from 50% in 2022. Similarly, men achieved a record-high participation rate of 62.9%. Seniors (aged 65 and older) also drove growth, with their participation rate increasing by 11.5% from 2022 to 2023. Moreover, the LGBTQ+ community continues to be an active cohort, accounting for 11.3% of the outdoor participant base.

Ethnic and racial diversity is also on the rise. In 2023, the percentage of Black participants increased from 9.4% to 10.3%, while Hispanic participation rose from 12.6% to 13.4%. Conversely, the percentage of White, non-Hispanic participants decreased slightly from 71.2% to 69.7%. This trend mirrors the growing diversity of the U.S. population as a whole.

The Challenge of Frequency

While the number of participants has grown, the report reveals a concerning trend in the frequency of participation. Over the past decade, the average number of outings per participant has remained relatively flat, with a significant decline in the number of core (very frequent) participants. In 2023, 88.4 million participants were considered core, down from 99.4 million in 2019. The average percentage of core participants across all outdoor activities was 28.8%, a notable drop from previous years.

The decline in frequency is concentrated among those who participate the most frequently, with the sharpest decreases seen in the categories of 104-to-259 outings per year and 260-or-more outings per year. This trend is a flashing red light for the outdoor industry, indicating a potential loss of committed participants and reliable consumers of outdoor products.

Casual Participants: A Growth Opportunity

Amidst these challenges, the report identifies an opportunity to engage a more diverse group of casual participants who participate in the most accessible outdoor activities, such as hiking, running, camping, bicycling, and fishing. Casual participants make up 40% of the total participant base and are more likely to be motivated by experiences such as connecting with friends, boosting mental health, and enjoying nature. These participants are not interested in high-tech gear, perfecting skills, or winning races but rather seek simple, shareable experiences.

Strategies for Engagement

To capitalize on this growth opportunity, the report recommends efforts to better understand and engage casual participants. This includes tailoring marketing and outreach efforts to their preferences and motivations, fostering inclusive environments, and developing products and services that cater to both frequent and infrequent participants.

商派官方订阅号

领取相关报告

近期文章

- 英伟达重磅报告:2026 零售消费品行业 AI 迎关键转折,全链路赋能重塑行业竞争格局

- 90 后接棒买年货!2026 春节消费新趋势:“健康硬通货 + 玄学好彩头”成为年味儿的双重打开方式

- 2026春节后红利爆发:六大核心赛道定方向,这五类人最易抓住机遇

- TikTok2026 全球趋势报告:品牌不可替代的本能,才是流量核心

- 人群白皮书 | 一边凑满减一边冲演唱会?“薛定谔的钱包” 背后:2026 消费真相是 “务实 + 悦己” 双驱动

- YSL 眼影刷屏、泡泡玛特出圈、丸美霸榜:2025 消费双轨时代,情绪与长期主义的增长密码

- 2026年大快消企业B2B经销商订货平台积分商城怎么搭建?

- 2026年运动服饰品牌全渠道零售运营优化方案:全渠道OMS业务中台驱动增长

产品推荐

- 品牌云店新零售商城 品牌连锁O2O新零售商城系统

沪公网安备 31010402000102号

沪公网安备 31010402000102号

电子营业执照

电子营业执照